There’s so many things to get organised when you are planning a trip or a holiday.

I spend a lot of time deciding where to go. It’s an obvious one, right?

Once you’ve decided on your location, you probably spend just as much time, if not more, deciding how to get there and where to stay.

Once all these holiday decisions are made, you start to think about all the fun stuff.

We all love planning our days out, checking out places to visit and planning which local restaurants to visit, don’t we?.

These are all really important decisions, don’t get me wrong.

But lots of travellers and holiday makers are missing a trick, and it’s costing £££s.

Planning Your Travel Budget

How many of us put dealing with travel money at the top of our holiday to do list?

I don’t just mean going to the exchange and picking up some Euros. That’s the very least we need to do, right?

If we prioritise making plans around our travel money, we can literally save £££s. Did you realise that? It turns out lots of holiday makers don’t!

Hidden Bank Charges

In a recent survey by HSBC, it was revealed that 56% of British holiday makers are unaware of their card provider charges when travelling abroad.

I’ve often wonder if it is best to use cash or a bank card abroad and today we’re going to answer that question.

I’ll be honest, I am completely unaware what my bank charges me to use my card abroad, and it turns out that if I did, I’d be able to save myself a lot of money!

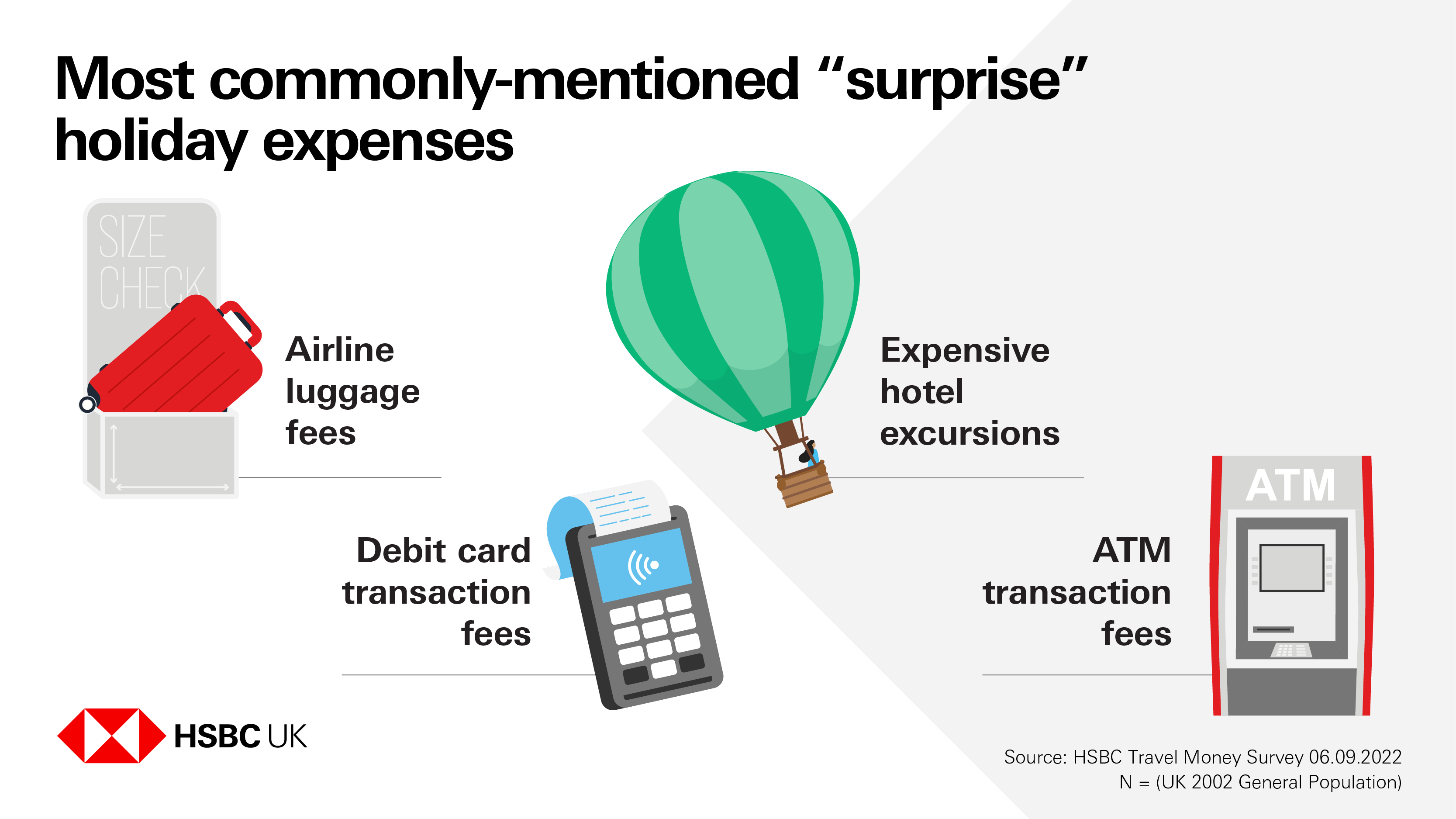

I was shocked to discover what the typical bank charges are for using my debit card abroad to make purchases. It is likely to be between 2.79% and 2.99% per transaction.

In monetary terms, this means that if I spent 1000 Euros during my holiday, I could be charged around £25. This shocked me!

Drawing cash out abroad, which I confess I do on every single European holiday I’ve ever been on, it turns out is another way you can blow your holiday budget without knowing.

It typically costs either 2% or a minimum of £3 to draw out money abroad. This means that if you withdraw 200 Euros 5 times over the duration of your travels, it could cost you around £42.

Can you see how these financial blackspots can end up mounting up?

British holiday makers have changed their travel habits during the cost of living crisis, with 20% now travelling off peak, which I’m a huge fan of personally for many reasons.

To really keep a handle on the travel budget though, not being caught out by bank and debit card charges will make a huge difference to your spending money.

There are things you can do to make sure you stay within your travel budget.

Here’s my top tips:

- Plan for all your spending: The one thing people forget is that they will need cash for tips, and this can lead to more trips to the cash point than you anticipated. Add your tips to your travel budget to ensure you have enough cash for your trip.

- Pay in local currency: So many times have I got to the checkout and not known how to answer the currency question. It’s not a great time to start googling it either! The answer is to pay in local currency to save cash.

- Take advantage of freebies: Take advantage of any free local landmarks and free transport where you can. Many locations and hotels have a free transport system you can use to get to central locations.

- Take a Travel Money Card: Avoid bank charges and keep your travel money secure by using a travel money card when you travel.

- Know the Bank Charges: If you do use your card, know the fees so you can mimimise the costs of spending abroad.

The next time I travel abroad, I will be making sure I know how much cash I need and how much my travel spending is going to cost me.

It has definitely jumped up the list of priorities in my travel planning.

What will you do differently the next time you travel abroad?